Calculate loan to value for heloc

Before receiving a HELOC you may be required to pay an application fee for a home appraisal title search and attorney fees. If you currently have a mortgage your LTV ratio is based on your loan balance.

Home Equity Line Of Credit Heloc Rocket Mortgage

In this case you would take the amount you borrowed and multiply it by your interest.

. How much loan interest the lender charges is determined by various factors including your credit history annual income loan amount loan terms and the current amount of debt you have. A loan-to-value LTV ratio is a financial term used by lenders to describe the ratio between the value of your home loan and the homes value and represent the first mortgage line as a percentage of the total appraised value of your home. In a z-table the zone under the probability density function is presented for each value of the z-score.

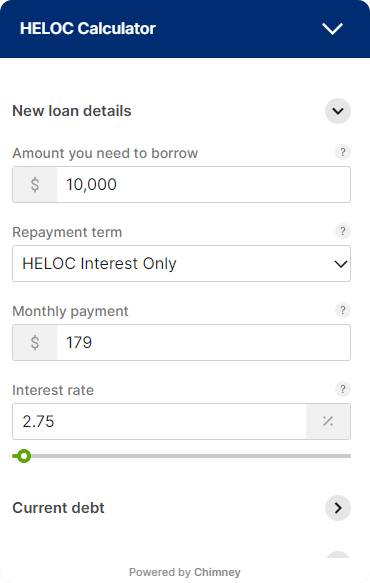

How to Calculate the APR of a Term Loan. Payments only include interest accrued on the loan no principal during the draw or borrowing period. Get ALL the same advantages of a standard HELOC with the same low rate.

More Home Equity Line of Credit HELOC Definition. The loan-to-value LTV ratio is a lending risk assessment ratio that financial institutions and other lenders examine before approving a mortgage. You need three numbers.

Home equity loans typically range from 5 to 15 years. Common Home Equity Loan Uses. What is the formula to calculate p-value.

The calculator will give your current loan-to-value ratio the percentage of your homes value that you owe to your mortgage lender and whether you might qualify for a HELOC or need to. If you owe 50 of your home value on your mortgage you would be eligible for a HELOC of up to. Calculating the APR of a loan is simple.

If youre not sure how much youre eligible for use our home equity loan and HELOC amount calculator first. Loan-To-Value Ratio - LTV Ratio. Lets calculate your costs if you have a 20000 loan with a 6 percent APR and a repayment term of 10 years.

If you own at least 20 of your home an LTV of 80 or less youll probably qualify for a home equity loan depending on. Some of the most common uses are. When combined with a mortgage your Cumulative Loan To Value CLTV cannot exceed 80.

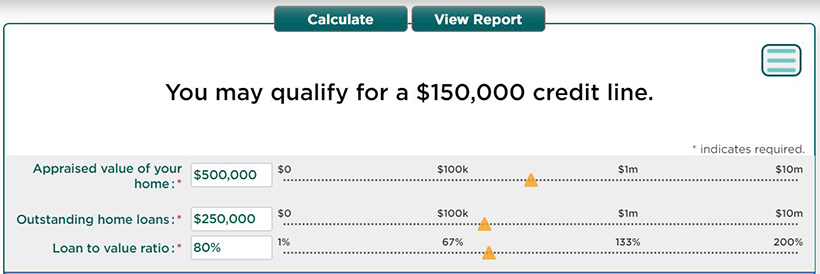

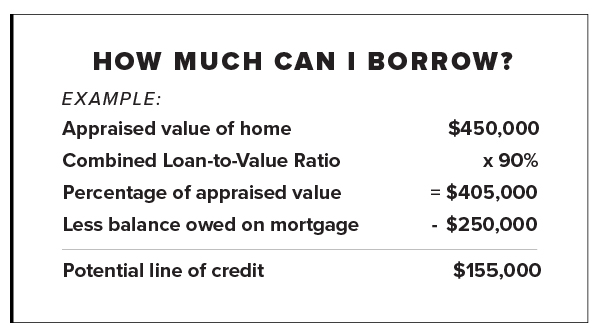

Loan-to-value ratio LTV is the percentage of your homes appraised value that is borrowed - including all outstanding mortgages and home equity loans and lines secured by your home. To calculate your LTV divide your loan amount by the homes appraised value or purchase price. You currently have a loan balance of 140000 you can find your loan balance on your monthly loan statement or online account and you want to take out a 25000 home equity line of credit.

Home buyers who have a strong down payment are typically offered lower interest rates. Enter your loans interest rate. Your credit qualifications amount of the line of credit Loan-to-Value LTV ratio and type of property.

When you first apply for a mortgage this equation compares the amount of the loan youre seeking to the homes value. It is very difficult to calculate p-value manually. CLTV All Loan Amounts Property Value LA 1 LA 2.

The most commonly employed way of doing this is to utilize a z-score table. One common measure lenders may use to make a decision about loans and financing is loan-to-value ratio LTV. Home equity loan rates are between 35 and 925 on average.

But enjoy a smaller minimum payment just interest accrued on the loan since the previous due date or 50 whichevers greater. The loan-to-value ratio LTV ratio is a lending risk assessment ratio that financial institutions and others lenders examine before approving a mortgage. Your home currently appraises for 200000.

Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan. The tool will immediately calculate your current loan-to-value ratio. 15000 minimum loan amount required.

If you dont need to borrow a large sum of money these. Unlike a home equity loan or HELOC. Less common when auto manufacturers offer low loan rates but when auto rates are higher than equity rates.

So your combined loan-to-value equation would look like this. LA n Property Value. In Canada you can only borrow up to 65 of your homes value with a HELOC.

To calculate your equity subtract the amount you owe on your current mortgage from the market value of your home. Enter your loan term. Divide the finance charge 400 by the loan balance.

This is the annual interest rate youll pay on the loan. Please call for complete details. Repairs additions vehicle purchase.

Loan-to-value ratio for mortgage. Up to 95 LTV with a HELOC Combo Calculate your available funds. Where LTV is the loan to value ratio LA is the original loan amount PV is the property value the lesser of sale price or appraised value.

This means that your mortgage and HELOC combined cannot exceed 80 of your homes value. To illustrate lets calculate the APR on a 1000 loan with a 400 finance charge and a 90-day term. For example a lenders 80 LTV limit for a home appraised at 400000 would mean a HELOC applicant could have no more than 320000 in total outstanding home.

The amount borrowed the total finance charge and the term length of the loan. Make more home renovations. The Loan to Value Calculator uses the following formulas.

Be prepared for the upfront costs. Debt-to-income DTI ratio Lenders also consider your debt-to-income ratio. Pay off more high-interest debt.

Homeowners tap home equity for a wide variety of reasons. Lenders typically require you to have at least 15 to 20 equity in your home to qualify for a HELOC or home equity loan. LTV Loan Amount Property Value.

Here are the most important disadvantages and advantages to be aware of before applying for a HELOC loan. Consolidating high-interest credit card balances other debts home improvement.

How A Heloc Works Tap Your Home Equity For Cash

Applying For A Home Equity Loan Navy Federal Credit Union

What Can Your Heloc Home Equity Line Of Credit Do For You

Home Equity Line Of Credit Heloc Rocket Mortgage

Looking For A Heloc Calculator

Home Equity Loans Selco

Home Equity Line Of Credit Qualification Calculator

How To Calculate Your Home Equity Finder Com

Heloc Calculator

Home Equity Line Of Credit Heloc Macu

Home Equity Line Of Credit Heloc Signal Financial Fcu

What Is A Home Equity Line Of Credit Or Heloc Nerdwallet

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Uccu

What Is A Home Equity Loan Or Line Of Credit Mid Hudson Valley Federal Credit Union

Home Equity Calculator Free Home Equity Loan Calculator For Excel

Home Equity Loan Or Line Of Credit Which Is Right For You Dupaco